The launch over the last few weeks by the Bombay Stock Exchange (BSE) and the Istanbul Stock Exchange (ISE) of their debut equity indexes which comply with non-interest based Islamic investment principles is potentially a major development for the Islamic capital market and asset management industry.

ndia with the world’s largest Muslim minority of between 150 million to 200 million and Turkey with a population nearing 70 million, are both untapped markets for Islamic investment funds especially equities, exchange-traded funds (ETFs), exchange traded commodities (ETCs) and index-linked equity funds. These funds of course are not only aimed at Muslim investors but also at those interested in alternative ethical and socially-responsible investment products. Indeed, in India other faith groups including Hinduism, Buddhism, Sikhism and Christianity also share with Islam some of the views relating to usury, wanton speculation and market greed.

However, both the BSE Tasis Shariah 50 Index launched on Dec. 27, 2010 and the ISE Participation Index KATLM launched on Jan. 6, 2011, are merely the beginning of an initiative to promote ethical funds as a niche offering on both stock exchanges. Any euphoria that these indices will open the floodgates to a spate of offerings of Islamic mutual funds, unit trusts, ETFs and ETCs should be dispelled immediately because Islamic asset management has been slow to take off globally compared with say sukuk (Islamic securities) and real estate financing. The global Islamic asset management business ranges between $30 billion to $50 billion, which is a drop in the ocean compared with the multi-trillion dollar conventional fund business.

Turkish bankers such as Meliksah Utku, assistant general manager of Albaraka Turk Participation Bank, and Avsar Sungurlu, assistant managing director of BMD Securities, which in 2006 launched the first Islamic exchange-traded fund (ETF) in the world off the Dow Jones Islamic Marker (DJIM) Index, have long been predicting that Islamic capital market instruments will eventually take off in Turkey.

In the past Turkish participation banks were constrained as to the types of business lines they could get involved in compared with their conventional banking counterparts. Following the introduction of the Banking Act 2007, the country’s four participation (Islamic) banks — Albaraka Turk, Kuveyt Turk, Turkiye Finans and Asya Finans Participation Banks — were brought under the same provisions of the above act, which meant that the regulatory regime was exactly the same as for the conventional banks.

In a recent interview with the writer, Durmus Yilmaz, the governor of the Central Bank of Turkey, confirmed that the country’s participation banks are part of the Turkish financial system and are “on the same footing as other financial institutions in Turkey, and can conduct asset management and capital market business. The only constraint is that their transactions do not involve interest”.

The ISE Participation Index KATLM effectively comprises 30 stocks of local companies quoted on the ISE whose business activities and financial ratios such as debt to market capitalization and interest income comply with Islamic investment principles. Some of the stocks included in the KATLM Index are retail giant, BIMAS.IS, Turk Telekom, Asya Bank, Emlak Konut, a real estate investment trust (REIT) and construction giant Enka Insaat, founded by the pioneering Sarik Tara.

Perhaps it is not surprising that BMD Securities is the consultant to the ISE on the establishment of the ISE Participation Index KATLM. BMD Securities in fact issued and managed the Dow Jones Islamic Market (DJIM) Turkiye Exchange-traded Fund (ETF) way back in 2006 on behalf of the then Family Finans which subsequently merged with Anadolu Finans to form the Turkiye Finans, in which Saudi Arabia’s National Commercial Bank (NCB) has a controlling stake. BMD Securities was also the index maker to the ETF which tracked the stocks on the DJIM Turkey Index. Last year, BMD also managed the first ETF, GoldPlus ETF, launched by Kuveyt Turk Participation Bank. It also manages a number of Islamic equity funds on behalf of Turkiye Finans including the BMD Equity Investment Fund, the BMD Gold & Energy Fund and the BMD Construction Fund.

In contrast, the BSE Tasis Shariah 50 Index is a joint effort between the BSE, one of India’s largest stock exchanges, and Taqwaa Advisory and Shariah Investment Solutions (TASIS) which the promoters hope would unlock the potential for Islamic ethical investments in India.

The BSE Tasis Shariah 50 index consists of the 50 largest and most liquid Shariah compliant stocks within the BSE 500. These include Indian corporate giants such as Reliance, Bajaj Auto, Ashok Leyland, Siemens, Tata Global, Bharti Airtel, Hindalco etc.

According to the promoters, the index has its own in-house Shariah screening process done by Tasis, which has adopted financial screens that are more conservative than its peers.

BSE Managing Director and CEO Madhu Kannan is confident.

“The introduction of the BSE Tasis Shariah 50 Index will give Islamic and other socially responsible investors another means to access the Indian market and will help attract pools of capital to India from the Gulf, Europe, and Southeast Asia,” said Kannan. “This index will create increased awareness on financial investments amongst the masses and help enhance financial inclusion. The index will also build a base for licensing for the construction of Shariah compliant financial products including mutual funds, ETFs, and structured products.”

The BSE Tasis Shariah 50 employs index constituent weight capping. Index constituent weights are capped at 8 percent at re-balancing, in an effort to increase the diversification within the index and ensure greater compliance with international regulatory and statutory investment guidelines.

The index follows a spate of Islamic equity funds aimed at the nascent Indian market either as standalone country funds or as part of a BRIC offering. In October 2010, for instance, India’s Tata Group launched its debut Tata Indian Shariah Equity Fund (TISEF) through its Tata Asset Management (Mauritius) Private Ltd. (TAMM), which is also the fund manager. This follows the establishment by the rival Reliance Anil Dhirubahi Ambani Group of a dedicated Islamic asset management company in Malaysia, Reliance Asset Management Malaysia Sdn Bhd, a subsidiary of Reliance Capital Asset Management (RCAM) in late 2009 to spearhead its global Islamic asset management activities. RCAM has embarked on a global Islamic asset management and fixed income strategy which will see the launch over the next few months of five Shariah-compliant funds — a global equity fund, an India country fund, a BRIC fund, a money market fund and a global sukuk fund.

At the same time, QInvest, the Qatari investment bank, has also recently ventured into the Islamic asset management sector by partnering with Ambit, one of India’s premier financial services group, to launch the Ambit QInvest India Fund, an open ended Shariah-compliant Indian equities fund.

According to QInvest, the fund is the region’s first and India’s largest Shariah-compliant equity fund with an investment strategy that will combine dynamic equity allocation to generate returns.

source : arabnews.com

No Comments »

No comments yet.

RSS feed for comments on this post. TrackBack URL

Leave a comment

- 3d islamic wallpaper

- Afghanistan muslim girls

- Algeria Muslim

- Allah Miracle wallpapers

- Allah Wallpapers

- arab muslim girls

- Birds Wallpapers

- Chinese Muslim Photo

- Chinese Muslim Photos

- desktop wallpaper

- Economic News

- Egypt Muslim

- EID 2010 Photos

- Flood in Pakistan

- Health, Beauty and Islam

- Hindi News

- history of islam

- Home Page

- India muslim girl

- Indian News

- Indonesia Muslim Girl

- Iran Muslim

- Iraq Muslim

- islam religion

- islam symbol

- islamic art

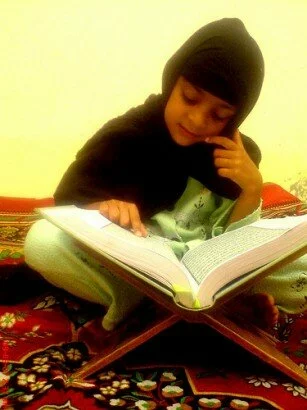

- islamic books

- islamic calendar

- islamic calligraphy

- Islamic Cloths

- Islamic History Wallpaper

- Islamic Photos

- islamic places

- Islamic Sayeri

- islamic video

- Islamic Wallpapers

- Israel Muslim

- Japan Muslim Photo

- Jordan Muslim

- kalima shahada mentioned in quran

- Karbala Photos

- kerala muslim girls

- Kissing Photos

- Latest News

- Latest Posts

- Malaysia Muslim

- Marriage And family

- marriage in islam

- Modern Muslim Women & Challenges

- Mosque

- Mosque Wallpapers

- Muharram Photo

- Muslim baby wallpaper

- Muslim Boys singapore

- Muslim Fashion Girl

- Muslim Girls

- muslim girls hijab

- muslim girls in bangalore

- muslim girls in china

- muslim girls in hyderabad

- muslim girls in pune

- muslim girls in uk

- Muslim Photo From Around the world

- Muslim Women World

- Nigeria Muslim

- Pakistan News

- Pakistan Photos

- pakistani girls

- Palastine muslim

- Palestinians Muslim

- Quran Quotes

- Ramadan Wallpapers

- Random 40 Hadith

- Saudi Arabia Muslim

- Saudi Arebia Girls

- singapore

- Singapore Mosque

- Singapore Muslims

- single muslim girls

- South Korea Muslim

- Stories of sahaba

- Tajikistan Muslim

- tamil muslim girls

- Turkey Muslim

- UK Muslim

- United Arab Emirates

- Urdu News

- USA Muslim

- Women's Rights in Islam

- World

- اسلامی تاریخی تصاویر

- اسلامی ڈیزائن گھر

- خوبصورت جگہ کا تصوير

- خوبصورت مسجد کا تصوير

- Say: In truth He is the One Allah.

- Allah Himself is witness, there is no god but He. The angels and the men of learning too are witness.

- There is no God save One Allah.

- Allah is sufficient for me. There is no God save He(Allah). In Him I have put my trust. He is the Lord of the Tremendous Throne.

- This is Allah your Lord. Him, therefore ,you should worship.

- Born With a True Soldier Spirit – The Noble Sa’eed bin Zayd (RA)

- Hadrat Bilal R.A : The glittering star of Islam

- Sa`D Ibn Abi Waqas (RA) – The Father Of Arab-China Political Relations

- Hadith of the ten promised paradise

- Tallha bin Ubaidullah (RA) – The Living Martyr

- Hadrat Ammar R.A. and his parent’s afflictions

- Why ARE so many modern British career women converting to Islam?

- Beaituful Indonasian Model

- Modern Indonasian Muslim Model

- Jobs, Women and Islam

- The Fight for Rights: Muslim Women

- Oppression faced by Muslim Women

- Muslim women as Wives

- Muslim Women and jobs in the modern World

- Muslim Women after 9/11

- The differences between Western feminism and Islamic feminism concerns the issue of veiling.

- Nice Woman photo

- Young Libyan Woman photo

- Veiled Yemeni women in computer class, Taiz Yemen.

- Yemen Mystery woman of Al Mukhala Fish Market

- Women Banned from American Court for wearing niqab

- Why does Taslima Nasrin want to burn the Hijab

- Walking to Change the World

- This lady has gone back to her native place in Andhra she visited my work place every Thursday

- These girls are just like any other girls in the world, they love to sit around and talk.

- The Muslim World Within a World

- Thai Muslim girls watch a Silat demonstration

- Surat Web Design

- Web Desgin Company

- Hindu Blog

- Good site, where did you come up with the knowledge in this

- Is there 1 Wpress plugin that all internet sites must have ?

- Wonderful publish. I just found your web page and would like

- I used to be just searching at associated blog content for m

- This website is great. I am gonna put this in my bookmarks b

- You completed a few fine points there. I did a search on the

- The new Zune browser is surprisingly good, but not as good a

- Thank you, I have recently been searching for information ab

- Great site, where did you come up with the info in this post

- Preach not to others what they should eat, but eat as become